CONTRIBUTIONS TOWARDS THE SUCCESSFUL OPERATION OF THE ONLINE LOAN APPS”

INTRODUCTION

Online loan apps have revolutionized the loan application process, but the success of these apps relies on the expertise of IT professionals. These professionals create user interfaces and safeguard sensitive data, ensuring a smooth, secure, and fast borrowing experience. Their contributions are crucial to the success of these apps.In a loan banking company, the IT (Information Technology) person plays a crucial role in ensuring the smooth and efficient operation of the company’s technology infrastructure and software systems. Their responsibilities include:

SUMMARY

IT professionals are crucial in designing, developing, and maintaining online loan apps, ensuring their seamless operation, data security, and efficient performance. Their continuous monitoring and maintenance ensure real-time loan processing and quick approvals, making borrowing safer, convenient, and reliable for financial needs.

EXPLAINING THE KEY POINT AND ROLE THE IT PROFESSIONAL PLAY IN THE ONLINE LOAN APPS

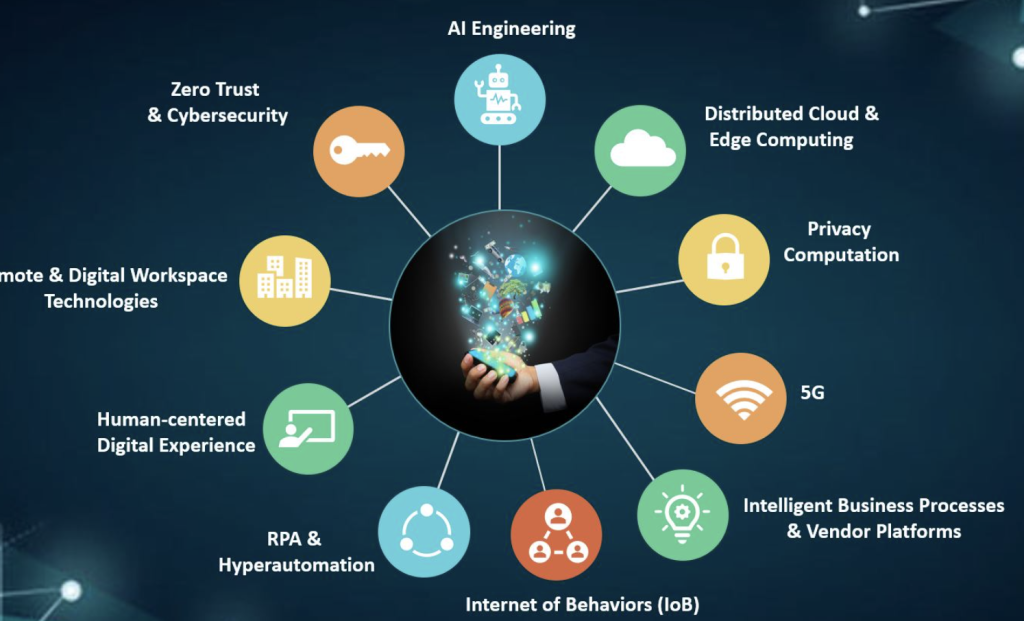

In the context of online loan apps, IT (Information Technology) plays a critical role in ensuring the successful operation and overall efficiency of the platform. Their contributions are instrumental in providing a seamless and secure user experience while maintaining the app’s stability and compliance. Here are some key roles and contributions of IT in this field:

1. APP DEVELOPMENT AND MAINTENANCE;

IT professionals are at the forefront of app development for online loans. They work closely with UX/UI designers and stakeholders to craft an intuitive and user-friendly interface. From conceptualizing the app’s layout to implementing secure authentication mechanisms, IT experts ensure that the user experience is smooth and hassle-free.

The heart of the online loan app lies in the loan application process. IT professionals design and implement this critical flow, incorporating efficient data entry forms, real-time validation, and document upload functionalities. They focus on minimizing friction and simplifying the process to enable users to apply for loans effortlessly.

App performance directly impacts user satisfaction. IT experts optimize app performance by optimizing code, streamlining database queries, and using caching mechanisms to reduce load times. Regular testing and profiling are conducted to identify and resolve performance bottlenecks.

2. DATA SECURITY AND PRIVACY;

Data security is a top priority for online loan apps, considering the vast amount of personal and financial information involved. IT professionals employ advanced encryption protocols to protect user data during transmission and storage, ensuring that sensitive information remains unintelligible to unauthorized individuals. They establish secure communication channels, utilizing HTTPS and SSL/TLS certificates to prevent eavesdropping and man-in-the-middle attacks.

User authentication is another crucial aspect of data security. IT experts implement strong authentication methods such as two-factor authentication (2FA) or biometric verification to ensure that only authorized users can access their accounts.

Moreover, IT professionals proactively monitor for any potential vulnerabilities or security breaches, conducting regular security audits to identify and mitigate risks. They stay abreast of the latest cybersecurity threats and continuously update the app’s security infrastructure to counter emerging challenges.

Privacy is equally vital in the online lending industry, and IT professionals take extensive measures to protect user privacy. They adhere to data protection regulations such as GDPR or CCPA, ensuring that user data is collected, processed, and stored in compliance with relevant laws. Privacy policies are transparently communicated to users, informing them about data usage and sharing practices.

3. SCALABILITY AND PERFORMANCE;

Scalability refers to the app’s ability to handle increasing user demands without compromising its performance. IT professionals design and implement strategies to accommodate growing user bases and surges in traffic during peak periods. They work tirelessly to scale up resources, including servers and networking equipment, ensuring the app can handle high volumes of loan applications without slowdowns or crashes.

Performance optimization is equally essential to provide users with swift responses and a smooth user interface. IT experts conduct rigorous testing, analyzing system metrics and fine-tuning configurations to minimize response times and enhance overall app performance. They employ caching mechanisms and load balancing to distribute the workload efficiently, optimizing resource allocation for improved speed and responsiveness.

Moreover, IT professionals continuously monitor the app’s performance, proactively identifying and resolving bottlenecks or potential issues before they impact users. By keeping a watchful eye on key performance indicators, they maintain the app’s reliability and responsiveness, fostering user satisfaction and trust.

In conclusion, the role of IT professionals in ensuring the scalability and performance of online loan apps cannot be overstated. Their expertise in scaling infrastructure, optimizing performance, and proactive monitoring enables borrowers to enjoy a seamless and efficient borrowing experience. With IT experts at the helm, online loan apps can handle the growing demand, provide rapid loan processing, and deliver on their promise of convenience and accessibility, thereby driving the continued success of the online lending industry.

4. INTEGRATION WITH BACKEND SYSTEMS;

In the ever-evolving landscape of online loan apps, seamless integration with backend systems is a crucial aspect that determines the success and efficiency of these platforms. IT person play a pivotal role in bridging the gap between the frontend user interface and the complex backend processes, ensuring a streamlined and responsive user experience.

Integration with backend systems involves connecting the online loan app with various essential components, such as payment gateways, credit scoring services, banking systems, and customer databases. IT experts work diligently to establish secure and reliable communication channels between the app and these systems, enabling smooth data transfer and real-time processing.

A key aspect of integration is data synchronization, ensuring that data entered by users on the app is accurately reflected in the backend databases and vice versa. IT professionals implement robust data validation and verification processes to maintain data integrity, reducing the likelihood of errors and discrepancies. Moreover, integration with backend systems enables automatic loan processing, accelerating the approval and disbursement of funds. By seamlessly connecting with credit scoring services and banking systems, IT experts empower online loan apps to make informed and timely decisions, reducing manual interventions and expediting the loan approval process.

Furthermore, IT professionals continually monitor the integration process, proactively identifying and resolving any issues that may arise. Regular testing and troubleshooting are conducted to ensure the app’s seamless functioning with backend systems, providing users with a reliable and efficient borrowing experience.

5. REAL-TIME PROCESSING;

Real-time processing in online loan apps refers to the ability to instantly process loan applications and provide borrowers with prompt responses. IT experts work tirelessly to design and implement systems that facilitate swift evaluation of loan eligibility, creditworthiness, and risk assessment. This involves seamless integration with credit bureaus and financial institutions, enabling real-time access to crucial data for quick decision-making.

To achieve real-time processing, IT professionals implement advanced algorithms and automated workflows that efficiently analyze and evaluate vast amounts of data. Machine learning and artificial intelligence are leveraged to assess borrowers’ creditworthiness, enhancing accuracy and minimizing manual intervention.

Moreover, real-time processing goes beyond just loan approval. IT experts enable real-time disbursement of funds to approved applicants, ensuring borrowers can access the funds they need swiftly and conveniently.

To maintain the integrity and reliability of real-time processing, IT professionals conduct rigorous testing and monitoring. They continuously optimize system performance, ensuring seamless scalability to handle increasing demands during peak periods.

6. RISK ASSESSMENT AND FRAUD PREVENTION;

Risk assessment in online loan apps involves evaluating the creditworthiness of borrowers and assessing the likelihood of loan default. IT experts work closely with data analysts and financial experts to develop sophisticated algorithms that analyze a multitude of data points, including credit history, income, employment, and financial behavior. This data-driven approach empowers lenders to make informed decisions and offer loans with appropriate terms, minimizing the risk of default.

Fraud prevention is equally critical in the online lending industry. IT professionals deploy advanced fraud detection algorithms that continuously monitor and analyze user behavior and transactions for suspicious activities. They implement multilayered security measures, such as identity verification, biometric authentication, and device recognition, to deter fraudulent loan applications and protect user data.

Moreover, IT professionals collaborate with industry regulators and law enforcement agencies to stay ahead of emerging fraud trends and comply with relevant regulations. They conduct regular security audits and vulnerability assessments to identify potential loopholes and address them proactively.

To maintain the integrity of risk assessment and fraud prevention systems, IT professionals continuously monitor and update these mechanisms. They fine-tune algorithms, adjust risk models, and adapt security measures to respond to evolving threats and changes in the lending landscape.

7. CUSTOMER SUPPORT TOOLS;

Customer support tools in online loan apps encompass a wide range of features and functionalities, all aimed at assisting users with their inquiries, troubleshooting issues, and providing timely assistance. IT experts collaborate with customer support teams to understand user pain points and design tools that address these challenges effectively.

One of the key customer support tools is the chatbot, a virtual assistant that can provide instant responses to user queries. These chatbots are equipped with artificial intelligence and natural language processing capabilities, enabling them to engage in meaningful conversations with borrowers, providing answers to frequently asked questions, and guiding users through the loan application process.

Ticketing systems are another essential customer support tool employed by IT professionals. Users can submit support tickets through the app, detailing their issues or concerns. IT experts ensure that these tickets are promptly assigned to the relevant support personnel, allowing for efficient resolution of user inquiries and problems.

Moreover, IT professionals integrate real-time communication channels such as live chat or in-app messaging to facilitate direct interactions between users and customer support representatives. This real-time communication enhances user satisfaction, as borrowers can receive immediate assistance without having to leave the app.

To ensure the effectiveness of customer support tools, IT professionals continuously monitor user feedback and analyze support metrics. They use this valuable data to identify areas for improvement and enhance the tools to better meet user needs.

8. ANALYTICS AND REPORTING:

Analytics and reporting in online loan apps involve the collection, analysis, and interpretation of vast amounts of data to derive actionable insights. IT experts leverage advanced data analytics techniques to process and transform raw data into valuable information. They develop algorithms and models that can identify patterns, trends, and correlations within the data, helping lenders make informed decisions about loan approvals, risk assessment, and interest rates.

Through comprehensive reporting, IT professionals provide lenders with concise and actionable summaries of the app’s performance, loan portfolios, and customer behavior. These reports offer valuable insights into key performance indicators, loan repayment patterns, and user preferences, enabling lenders to optimize their lending strategies and improve profitability.

Furthermore, IT professionals collaborate with data analysts and business intelligence teams to develop interactive dashboards and data visualization tools.

These user-friendly interfaces allow lenders to explore data intuitively, gaining valuable insights at a glance and facilitating data-driven decision-making. Continuous monitoring of data quality and accuracy is another crucial aspect of analytics and reporting. IT professionals ensure that data is collected and processed accurately, adhering to data protection regulations and maintaining data privacy.

9. CONTINUOUS MONITORING AND MAINTENANCE:

IT professionals are crucial in the continuous monitoring and maintenance of platforms for a seamless borrowing experience. They use advanced tools to monitor server performance, network traffic, and response times, proactively detecting anomalies for optimal performance.

Regular maintenance is equally essential in preserving the integrity of online loan apps. IT professionals conduct routine checks, updates, and patches to keep the app’s software and infrastructure up to date. This helps prevent security vulnerabilities and ensures that the latest features and improvements are available to users.

Additionally, IT experts perform regular backups of the app’s data and databases, safeguarding against data loss due to unforeseen events such as hardware failures or cyber-attacks. Disaster recovery plans are also put in place to ensure quick restoration of critical systems in case of emergencies.

Moreover, IT professionals work closely with customer support teams, addressing user feedback and troubleshooting reported issues. They offer swift resolution to user inquiries and concerns, providing users with a positive experience and bolstering trust in the platform.

10. COMPLIANCE AND REGULATIONS:

Adhering to stringent compliance and regulations is essential to safeguarding the interests of borrowers and maintaining the integrity of the financial ecosystem. IT professionals play a crucial role in ensuring that these platforms operate within the boundaries of legal frameworks and industry standards.

Compliance and regulations in the online lending industry encompass various aspects, including data protection, anti-money laundering (AML), Know Your Customer (KYC) requirements, and consumer protection laws. IT experts work diligently to implement robust security measures, encrypting and protecting sensitive user data in adherence to data protection laws. They also design systems that facilitate thorough identity verification processes, ensuring compliance with KYC and AML regulations.

Furthermore, IT professionals collaborate with legal and compliance teams to stay abreast of evolving regulatory landscapes. They continually update the app’s infrastructure and processes to align with new laws and standards, preventing potential violations and penalties.

Data security is a critical aspect of compliance. IT experts ensure that user data is stored securely, and access is limited only to authorized personnel. They conduct regular security audits and vulnerability assessments to identify and address potential weaknesses proactively.

Moreover, IT professionals monitor and log user activities to maintain an audit trail, allowing for transparent reporting and compliance verification. This data is essential for regulatory reporting and investigations, ensuring transparency and accountability in the online lending process.

11. USER EXPERIENCE OPTIMIZATION:

User experience optimization begins with a deep understanding of user behavior and preferences. IT experts collaborate with UX/UI designers and conduct user research to identify pain points and areas for improvement. They use this valuable insight to design an intuitive and visually appealing interface that guides users effortlessly through the loan application process.

Navigation is a key aspect of UX optimization. IT professionals ensure that the app’s structure is logical and straightforward, enabling users to access essential features with ease. They design intuitive menus, clear call-to-action buttons, and well-organized content, minimizing the steps required to complete a loan application.

Furthermore, performance optimization is vital for a positive user experience. IT professionals continuously monitor the app’s speed and responsiveness, fine-tuning configurations and optimizing resource allocation to reduce load times. A fastloading app enhances user satisfaction and encourages repeat usage.

Personalization is another critical aspect of UX optimization. IT experts implement algorithms that tailor loan offers and recommendations to individual user needs, enhancing relevance and engagement. Personalized notifications and reminders also keep borrowers informed and motivated to complete their loan applications. Moreover, IT professionals conduct extensive usability testing to gather user feedback and identify areas for improvement. Regular app updates based on user insights ensure that the app remains relevant and user-friendly.

12. APP SECURITY AUDITS:

App security audits involve comprehensive assessments of the app’s security measures, infrastructure, and data protection practices. IT experts conduct rigorous tests, probing for vulnerabilities and potential weaknesses in the system. They analyze the app’s code, network configurations, and data storage mechanisms to identify any potential security loopholes.

The findings from security audits inform IT professionals about areas that require immediate attention and improvement. They work diligently to address the identified vulnerabilities, implementing necessary patches, and updates to fortify the app’s security.

Moreover, IT professionals collaborate with cybersecurity experts and compliance teams to ensure that the app adheres to industry standards and regulations. Compliance with data protection laws and financial regulations is integral to maintaining the integrity of the online lending ecosystem.

Regular security audits are an ongoing process to adapt to evolving threats and technologies. IT professionals continuously monitor the app’s security landscape, proactively mitigating potential risks and staying ahead of cyber attackers.

13. IT BUDGETING AND PROCUREMENT:

App security audits are thorough assessments of an app’s security measures, infrastructure, and data protection practices. IT experts test the app for vulnerabilities and weaknesses, identifying potential vulnerabilities and implementing necessary patches. They collaborate with cybersecurity experts and compliance teams to ensure app compliance with industry standards and regulations. Regular audits help mitigate risks and stay ahead of cyber attackers.

CONCLUSION

The successful operation of online loan apps relies heavily on the expertise and dedication of IT professionals who serve as the backbone of these transformative financial platforms. Throughout this project, we have explored the diverse roles played by IT experts, highlighting their indispensable contributions that ensure a seamless and efficient borrowing experience for users.

IT professionals also play a crucial role in app development and maintenance. They collaborate with UX/UI designers and stakeholders to create an intuitive and user-friendly interface that guides borrowers seamlessly through the loan application process. Regular bug fixing and updates ensure the app remains free of glitches, while security measures protect sensitive user data, safeguarding user privacy.

In addition to optimizing the user experience, IT professionals uphold the integrity of online loan apps through compliance and regulations adherence. They stay vigilant, conducting app security audits to identify vulnerabilities and proactively mitigating potential risks, ensuring the platform complies with data protection laws and financial regulations.

Lastly, IT professionals contribute to the financial viability of online loan apps through strategic IT budgeting and procurement. By efficiently managing resources and making sound technology investments, they enable the app to scale effectively and remain competitive in the market.